Personal loans are a verygood alternative to credit cards. They can assist you to provide funds for the purchase of things, and at the same, at a cheap interest.

However, it is very important to have a clear knowledge of the interest rates, refund terms and plans, whenever you wish to request personal loans.

For instance, if you wish to procure a 500 dollar loan using popular apps for instant money, you first ought to ascertain the interest rates, the terms involved, and the best plan to use to ensure a smooth and easy repayment.

Whether you wish to apply for several small funds or to procure one big loan, you must understand what each form of borrowing would offer to you. And how you can manage such conditions to ensure you get the best out of it.

How to Take out Several Small Personal Loans

There are no regulations from the Government that restrict someone from obtaining several credits. Nevertheless, some districts have prevailing laws that limit individuals on the maximum number of credits to obtain at a time.

Obtaining several small credits is very easy. Even if your credit rating is bad, you can still obtain funds from some lenders.

Some situations require one to take out several credits. But, before requesting, you must check if your total debt is greater than your earnings. If your earning is less than your total debt, you might not be able to procure funds from lenders.

Most creditors take into account your debt to income ratio which is the measure of your debt to the part of your earnings.

Also, before applying for several loans, have in mind that each moment you obtain credits, your debt to income ratio tends to increase. And creditors always prefer that your debt to income ratio falls below 40%. If this ratio falls above 40%, you’re most likely going to obtain a fund that comes with high-interest rates.

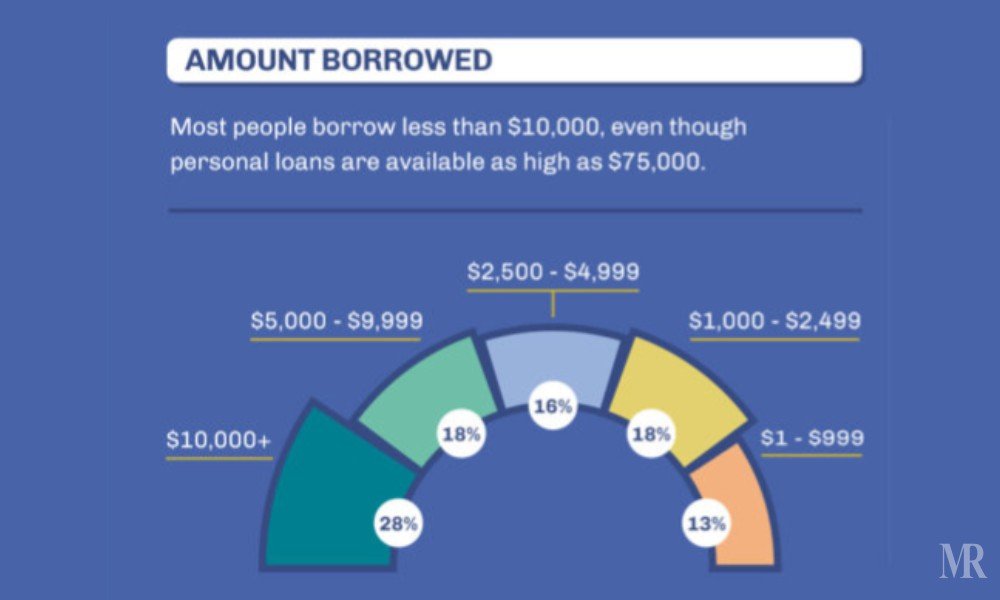

Research has shown that the use of personal loans is now on the increase, as over 19 million consumers in the U.S make use of it.

Here Are the Ways to Procure Several Small Loans

- Requesting for multiple credits from a particular lender. Some creditors offer multiple loans to consumers, while others may also limit the number of credits to borrow at a time. Also, some creditors might want you to clear out some of your debts before applying for another.

- Another means is to request credits from a different lender.

Is It Good to Take out Several Small Loans?

Yes, it is nice. When faced with the need to obtain small funds to take care of an unexpected urgent situation, you need to apply for small credits.

Benefits of Several Small Loans

1. It assists you to achieve numerous desires at the same moment. You can obtain cars, houses, devices at once.

2. It gives you the flexibility to access funds and use them the way you want and wish.

3. It gives you a feeling of financial protection.

Demerits of Taking out Several Small Credits

1. The interest paid on the accumulated loans will be much higher than the actual fund you borrowed.

2. It creates a sense of mental stress as you’ll be always worried about how to clear out your debts.

3. The different credit EMIs of the several borrowed loans are liable to be cleared out at the same time. This will put you in a state where you can’t make savings, and fulfill your monetary objectives.

4. There is every tendency that you might not be able to pay up the EMIs of some of the credits because of urgent financial needs that may come up. This puts you in a state where your credit record gets affected negatively.

5. Lenders may prevent you from obtaining several funds. Also, lenders may limit you on the number of credits to take out at a time.

Pros of Obtaining a One Big Loan

1. It offers a great opportunity to pay off those smaller several debts that have acquired higher interest rates over time.

2. It permits you to make only a single payment each month, unlike obtaining several small loans.

3. Using the big loan borrowed funds to settle all your debts, can keep you encouraged and make your condition very easy to control.

Cons of Obtaining a One Big Loan

1. The amount of funds you borrow affects your credit score. Borrowing larger sums of money can bring about a negative effect on your rating.

2. You might end up not being able to pay up the huge sum of money you borrowed.

What Type of Loan Is Better?

Selecting whether to apply for several small credits or one big loan depends on the condition or situation which you may be facing at the moment.

Generally, when you’re faced with an urgent emergency that requires little funds to solve such an issue, it’s necessary to apply for small credits. So, obtaining one big loan in such a condition is not necessary.

One big loan can be obtained, when you’re being faced with outstanding several debts, which need to be cleared on time to prevent the interest rates from increasing.

Also, when there is a need to purchase high-cost commodities such as expensive cars, houses, lands, etc; obtaining one big loan is highly economic, as it comes with low-interest rates, unlike several small credits.

Conclusion

Selecting whether to apply for several small funds or one big loan depends on the condition or situation which you may be facing at that period. You can obtain several personal loans by either requesting multiple credits from a particular lender or procuring small funds from different lenders.

Several small funds are best procured when you’re are facing some financial emergencies that require little funds. One big loan may be procured only when you wish to clear out several debts or obtain funds to carry out big investments such as purchasing cars, houses, lands, business start-ups, etc.

Also Read: Beginner’s Guide To Jumbo Loans