Samsung (KRX:005930) and AMD (NASDAQ:AMD) have recently announced a strategic collaboration to develop and manufacture microchips, signaling their commitment to staying ahead in the semiconductor industry. This partnership underscores the importance of innovation and technological improvement in microelectronics production.

A significant focus of collaboration between Samsung and AMD lies in producing HBM3E-type memory, a cutting-edge technology crucial for future computing requirements. While competitors like SK Hynix (KRX:000660) are also active in this arena, Samsung’s extensive experience and technological achievements have a huge advantage in this struggle for leadership. The agreement between Samsung and AMD includes a substantial $3 billion contract for the supply of HBM3E, solidifying their commitment to advancing memory technology together.

As the semiconductor industry develops and computing demands continue to rise, collaboration becomes essential for companies like Samsung, AMD, and TSMC (TWSE:2330) to create unique and competitive products. This partnership gives AMD access to Samsung’s cutting-edge technology, allowing it to produce innovative products like Instinct MI350 chips with the revolutionary HBM3E memory. Scheduled for release in the latter half of 2024, these chips will benefit from Samsung’s advanced memory technology, with TSMC handling chip production using cutting-edge 4-nm technology.

However, such intricate partnerships may pose challenges, particularly in terms of dependency on Samsung for memory and other components, potentially leading to production delays. Nonetheless, the overall benefits are substantial, driving industry development and innovation.

Samsung’s recent introduction of the HBM3E Shinebolt family chips, showcased in a 12-tier design, promises significant memory capacity and performance advancements. Mass production is set to commence in the latter part of 2024, further cementing Samsung’s position as a leader in memory technology.

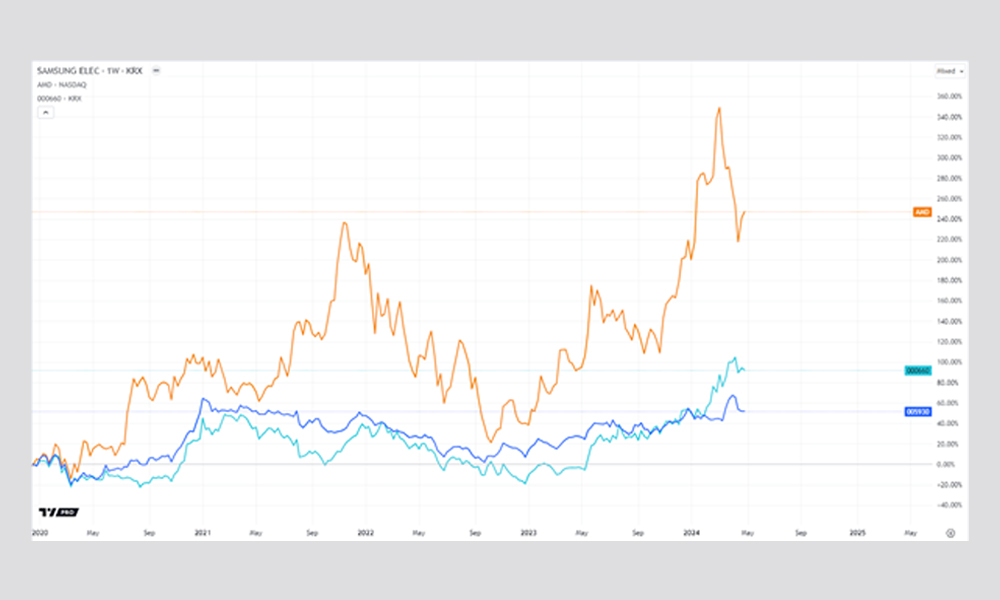

As a result, the cooperation of Samsung, AMD, and TSMC may be a plus for all participants, as it allows them to combine their technologies and experience to create advanced products. While the partnership may impact Samsung and AMD stock prices in the short term, investors generally view it as a positive step toward business growth and technological advancement.

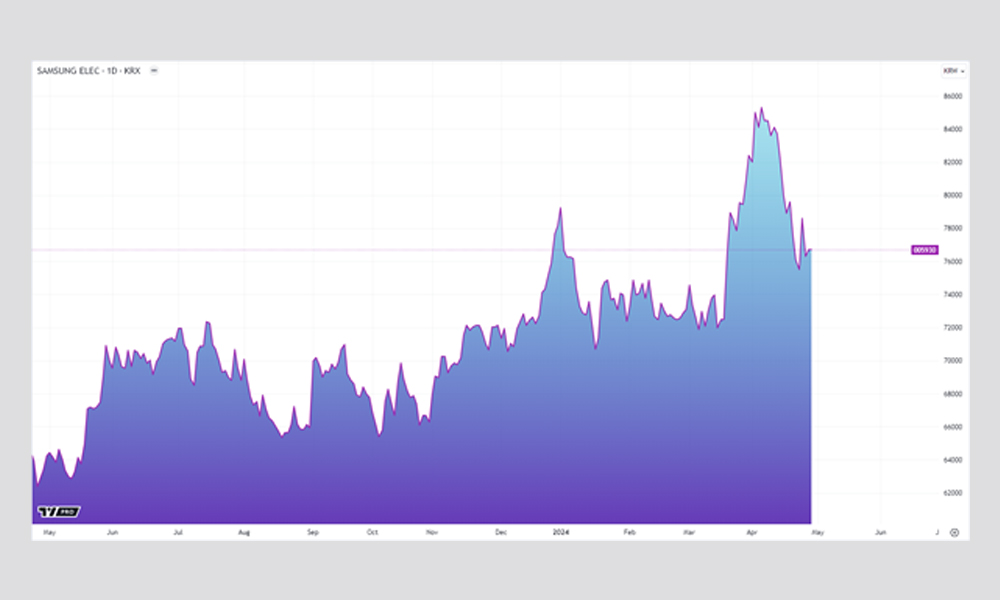

The trajectory of Samsung shares is based on its ability to keep up with the pulse of time and constantly develop. As the company continues to forge partnerships and advance microchip technology, its shares are poised for growth, presenting an attractive investment opportunity for discerning investors.

In conclusion, Samsung’s strategic collaborations and focus on microchip development position it as a front-runner in the industry, with considerable growth potential for investors seeking promising opportunities in the microelectronics market.

Also Read: The GPU wars: AMD vs. NVIDIA in the stock market battle