Family offices remain some of the most attractive clients for asset managers, ETF providers, fintech platforms, and consultants. These organizations manage the wealth of ultra-high-net-worth families, often investing in private equity, real estate, venture capital, and alternative strategies.

A robust database of family offices could help vendors accelerate prospecting, deepen relationships, and unlock allocations. The challenge is that not all lists are created equally. Many so-called “family office lists” found online become liabilities rather than assets.

This article examines why static lists fail vendors, what to look for in an effective resource, and how dynamic intelligence platforms outperform outdated spreadsheets.

What Vendors Should Expect From a Family Office List

Vendors aren’t simply chasing names; they need a way to connect with decision-makers who can engage with their offerings. A useful dataset should deliver more than a static spreadsheet full of family offices. It should include:

- Verified firm details to confirm the entity is a family office, not a mislabeled wealth manager.

- Decision-maker contacts such as CIOs, principals, and investment officers with valid emails.

- Investment intelligence that covers AUM, strategies, sectors of interest, or custodian ties.

- Fresh, regularly updated information that reflects industry changes in real time.

Anything less than this is a directory with limited business value. Static spreadsheets leave teams chasing dead leads, while dynamic RIA databases empower relationship-building with qualified prospects.

Why Static Lists Fall Short

Most downloadable lists share the same flaws:

- Outdated information as leadership changes and strategies shift faster than a one-time file can track.

- Incomplete profiles that provide only a name and city without meaningful context.

- Accuracy issues leading to bounced campaigns and wasted effort.

- Low ROI as outreach fails to reach true decision-makers, slowing sales momentum.

Vendors relying on these lists often find the frustration outweighs the results.

The Shift From Family Office Lists to Intelligence

The real distinction lies between a spreadsheet and an intelligence platform. Vendors need family office intelligence that is dynamic, verified, and filled with actionable data.

Traditional Static Lists

- One-time downloads that go stale quickly

- Limited firm information and generic emails

- No ability to filter or segment effectively

Modern Intelligence Platforms

- Continuously refreshed databases with verified contacts

- Firmographic data on AUM, strategies, custodians, and locations

- Segmentation tools to isolate the prospects that matter most

- CRM integrations for seamless workflow

Choosing between family office lists and intelligence (like RIA databases) is choosing between stalled outreach and sustainable growth. Vendors who embrace dynamic intelligence stop chasing outdated leads and start building relationships that convert into lasting revenue.

Static Family Office Lists vs. Dynamic Database: A Comparison

| Criteria | Static Family Office Lists | Dynamic Intelligence Platforms |

| Accuracy | Outdated quickly | Continuously refreshed |

| Detail Level | Minimal (firm name, city) | AUM, contacts, custodian, investment focus |

| Scalability | One-off download | Searchable, segmentable, CRM-integrated |

| ROI | Low, wasted outreach | High, targeted, efficient campaigns |

| Vendor Fit | Small one-off prospecting | Enterprise-ready growth strategy |

Poor data doesn’t just inconvenience vendors. It leads to lost opportunities and wasted resources. Every outdated record or incomplete contact is a door closed on potential revenue. A dynamic database keeps those doors open, giving vendors the accuracy and scale required to consistently win new business

Why Family Offices Are Hard to Track

Part of the appeal (and challenge) of targeting family offices is their elusive nature. Unlike RIAs, they:

- Have no central registry

- Operate with varying visibility (some maintain websites, many do not)

- Prioritize privacy to protect clients

This scarcity makes them highly valuable targets, but connecting requires verified intelligence rather than guesswork.

Adding to the difficulty, family offices vary widely in structure and investment mandate. Some operate like institutional investors with CIOs and research teams, while others resemble lean advisory groups run by a single principal. Without accurate intelligence, vendors waste valuable time trying to determine whether a firm is even a true family office, let alone the right fit for their outreach.

That’s why relying on static spreadsheets is a losing strategy. What’s needed is a dynamic solution that adapts to the shifting, private, and often opaque world of family offices.

What Vendors Actually Need Instead of Family Office Lists

When vendors search for “family office lists,” what they’re truly after is a solution that delivers:

- Accurate identification of confirmed family offices

- Segmentation options for AUM, geography, or investment themes

- Verified contact details for principals, CIOs, and analysts

- CRM integration to streamline execution

- Scalability that supports repeatable campaigns over time

- Dynamic platforms fulfill these needs in a way spreadsheets cannot.

Spreadsheets capture names. Intelligence platforms and databases unlock opportunities. The vendors who recognize this shift stop chasing data and start converting prospects into lasting relationships.

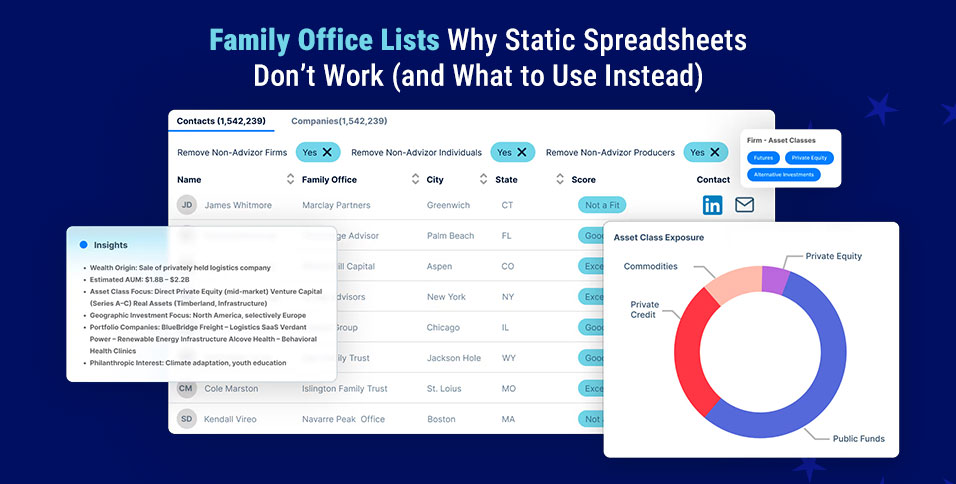

How AdvizorPro Closes the Gap

AdvizorPro’s RIA and Family Office Database addresses the shortcomings of static lists by offering a continuously updated database tailored for B2B targeting.

With AdvizorPro the vendors gain access to:

- Verified profiles with firm names, AUM, custodians, and strategies

- Decision-maker contacts complete with verified email addresses

- Segmentation filters for geography, size, custodian, or specialization

- CRM integrations with Salesforce, HubSpot, and more

- Scalable processes that make outreach repeatable and efficient

Instead of wasting money on outdated lists, vendors engage with the right offices through precise, data-driven targeting.

Practical Use Cases

Different vendors benefit from family office intelligence in unique ways. The value expands even further when paired with a comprehensive RIA database. Together, these datasets create a complete view of the private wealth landscape, allowing vendors to target both family offices and RIAs with precision.

Let’s look at how different vendors apply RIA databases in distinct ways:

- Asset Managers identify offices with allocations to alternatives or niche asset classes.

- ETF Providers focus on offices seeking cost-efficient diversification.

- Fintech Platforms connect with firms requiring technology for reporting and compliance.

- Consultants target family offices seeking legal, tax, or operational expertise.

The real advantage comes from uniting family office and RIA intelligence. Together, they provide a 360-degree view of allocators, ensuring vendors aren’t just reaching more prospects, but the right ones.

What to Choose Instead of Static Family Office Lists

Static spreadsheets don’t keep pace with a market that changes daily. They leave vendors chasing outdated names instead of engaging real prospects. A dynamic RIA database solves that problem by offering verified contacts, fresh data, and segmentation tools that make outreach scalable.

With accurate advisor data at their fingertips, vendors can build repeatable growth strategies and turn distribution into a competitive advantage.

For vendors searching for family office lists, a dynamic RIA database is the smarter alternative. It delivers verified intelligence, scalable outreach, and direct access to the allocators who matter most.