Mirror Review

February 11, 2026

Known for transforming music streaming into a global subscription habit, Spotify is now proving it can turn massive scale into durable profits.

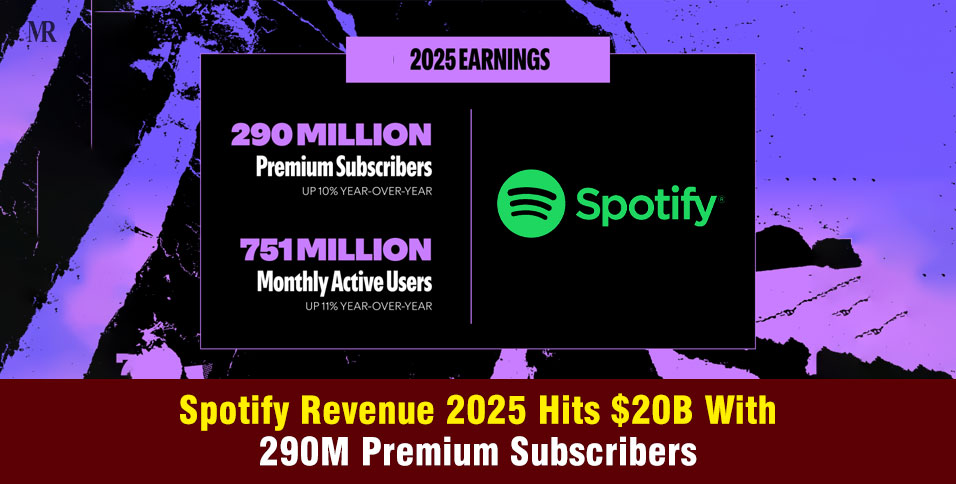

Spotify Revenue 2025 crossed $20.4 billion, driven by 290 million premium subscribers, stronger margins, and improved cash flow. This is not just a record year. It marks a fresh shift in how Spotify earns, spends, and sustains growth.

Here is what the latest Spotify earnings reveal and why 2025 stands out in the company’s history.

Spotify 2025 at a Glance

Here is a clear snapshot of Spotify’s 2025 performance, based on Spotify Q4 2025 earnings and the Spotify annual report.

- Full-year revenue: €17.19 billion or $20.4 billion

- Revenue growth: 10% year over year

- Premium subscribers: 290 million, up 10%

- Total monthly active users: 751 million

These figures from Spotify Q4 2025 confirm a long-awaited transition. Spotify is now operating like a mature global platform, not a cash-burning growth company.

How Spotify Revenue 2025 Crossed $20B

Here are the multiple factors that helped Spotify have a successful financial year 2025.

- Premium subscriptions did most of the work

Premium subscriptions remained Spotify’s main income source.

- Premium revenue made up nearly 90% of total revenue

- Spotify added around 25 million premium users in 2025

- Premium subscribers grew 10% year over year

- Premium users made up about 39% of total users

Moreover, in 2025:

- Premium revenue grew faster than ad revenue

- Subscriber growth stayed strong even after price hikes

This steady rise played a major role in Spotify’s revenue in 2025 to be profiitable.

- Wrapped Broke Records Again

Spotify’s 11th annual Wrapped campaign became its biggest yet with:

- 300 million engaged users

- 630 million shares

- Available in 56 languages

Wrapped is not just marketing. It increases app engagement, social sharing, and user retention going into the next year.

- Live Events and Ticketing Strengthened Artist Revenue

Spotify upgraded its Live Events feed, allowing users to:

- Follow venues

- Discover nearby shows

- Get personalized concert recommendations

In 2025, Spotify helped artists generate over $1 billion in ticket sales through ticketing partners.

This strengthens Spotify’s position as more than a streaming app. It is becoming a full music ecosystem.

- AI and Personalization Deepened Premium Value

Spotify expanded Prompted Playlist, which allows Premium users to describe what they want to hear in their own words. The feature uses listening history and real-time signals to generate playlists.

This improves personalization and gives Premium users more control, helping justify price increases.

- Music Videos and Audiobooks Expanded Platform Reach

Spotify launched music videos in beta for Premium users in North America. The feature is now available in 111 markets, expanding how fans experience artists.

The company also expanded audiobooks across Nordic markets and added hundreds of thousands of new titles.

These moves increase time spent on the platform and diversify revenue streams.

- $11 Billion Paid to the Music Industry

In 2025, Spotify paid out more than $11 billion to the music industry, the largest annual payout in history. Independent artists and labels accounted for about half of that total.

This is significant because artist payouts have historically pressured margins. The fact that Spotify Revenue 2025 crossed $20B while paying record royalties shows improved balance between growth and cost control.

Historical Context: Why 2025 Is a Turning Point

For most of its history, Spotify faced the same criticism. It grew fast, but profits stayed thin.

A major reason was artist and label payouts, which consumed a large share of revenue.

Spotify pays royalties on every stream, meaning costs rose automatically as listening increased. More users did not always mean more profit.

This led to years of pressure from:

- Music labels demanding higher payouts

- Artists criticizing low per-stream earnings

- Investors questioning whether margins could ever expand

For a long time, Spotify chose growth over margin protection, and 2025 marks the year that balance finally changed.

Spotify renegotiated licensing structures, improved pricing, and expanded higher-margin offerings like audiobooks and podcasts. At the same time, price increases helped offset royalty costs without slowing subscriber growth.

The result is clear in the numbers:

- Revenue grew

- Margins expanded

- Cash generation improved

Spotify 2025 results show a platform that learned how to grow without letting artist fees erase profitability. That shift is why 2025 stands out as a true turning point, not just another strong year.

What Comes Next: Spotify Q1 2026 Outlook

Spotify expects steady growth in the first quarter of 2026.

Spotify Q1 2026 projections include:

- Revenue: €4.5 billion or $5.36 billion

- Premium subscribers: 293 million

- Total Monthly Active Users: 759 million

- Gross margin (profit after content costs): 32.8%

- Operating income (core business profit): €660 million or $785 million

The company also expects to add 3 million premium subscribers and 8 million monthly active users during the quarter.

The outlook also includes €10 million ($11.9 million) in Social Charges related to stock-based compensation, based on a Q4 closing share price of $580.71.

Overall, the guidance suggests controlled, stable expansion following the strong Spotify Revenue 2025 performance, with profitability expected to remain intact.

Final Takeaway on Spotify Earnings 2025

Spotify Revenue 2025 crossing $20.4 billion signals more than scale. It confirms that the company has moved beyond growth-at-all-costs and into disciplined expansion.

For years, Spotify struggled to balance user growth with rising artist payouts. In 2025, it proved that pricing power, cost control, and product expansion can coexist.

With 290 million premium subscribers and stable margin guidance for 2026, Spotify now operates from a position of strength. And the real story is not just revenue growth, it is financial maturity.

Maria Isabel Rodrigues