Mirror Review

October 16, 2025

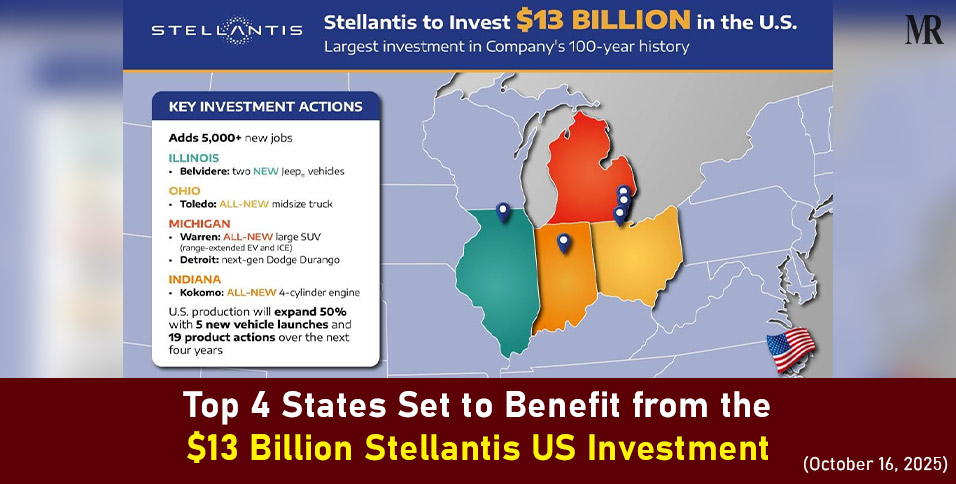

On October 14, 2025, Stellantis announced a $13 billion investment plan to expand its manufacturing in the United States.

This Stellantis US investment includes reopening closed plants, modernizing existing ones, and adding new production lines for vehicles, engines, and hybrid models.

It’s one of the largest U.S. expansions by a foreign automaker since the pandemic and shows a trend towards reshoring production closer to key markets.

The decision comes as automakers face rising costs from tariffs, supply chain delays, and new emission rules. By producing more vehicles domestically, Stellantis aims to strengthen its supply security, lower transport costs, and respond faster to changing consumer demand.

For many American towns once reliant on auto manufacturing, the move offers a chance to bring back thousands of jobs and spark regional economic recovery.

Here Are The 4 States Gaining the Most From The Stellantis US Investment Plan

1. Illinois — A Factory Comeback

Stellantis will invest over $600 million to reopen its Belvidere, Illinois plant, which was closed in 2023. The facility will now produce both the Jeep Cherokee and Jeep Compass, creating around 3,300 jobs by 2027.

Why Illinois stands out:

- The Belvidere plant already has infrastructure and a trained workforce, allowing production to restart faster.

- The state’s strong supplier network supports efficient manufacturing and logistics.

- Illinois is expected to offer competitive incentive packages, including tax credits and grants, to secure future Stellantis projects.

Local leaders call this a turning point for the region. As the Mayor of Belvidere noted, “This is a lifeline for our community — reopening the plant brings back jobs, revives local suppliers, and puts Belvidere back on the industrial map.”

If successful, Belvidere could become Stellantis’ U.S. growth anchor by restoring what was lost and positioning Illinois for long-term expansion.

2. Ohio — Expanding the Truck and Mobility Hub

Stellantis will invest nearly $400 million in its Toledo, Ohio facility to produce a new midsize truck model, generating 900 new jobs by 2028.

Why Ohio gains momentum:

- Toledo already builds the Jeep Wrangler and Jeep Gladiator, giving Stellantis an experienced workforce and established logistics.

- Ohio’s strong transport infrastructure of ports, rail, and highway links offers cost advantages for truck manufacturing.

- The new program broadens Stellantis’ U.S. portfolio beyond SUVs, signaling a push into profitable truck segments.

Over time, Toledo could evolve into a central hub for heavy vehicle production, reinforcing Ohio’s long-standing automotive legacy.

3. Michigan — Strengthening the Heart of U.S. Auto Manufacturing

As part of the Stellantis US investment, about $100 million will be invested to retool its Warren Truck Assembly Plant for a new large SUV (available in both EV and internal combustion versions) around 2028, and $130 million in its Detroit Jefferson plant to launch the next-generation Dodge Durango by 2029.

Why Michigan remains vital:

- Michigan is home to the U.S. auto industry’s core talent, suppliers, and innovation hubs.

- Maintaining a presence here keeps Stellantis close to R&D centers and ensures political and industry support.

- The state serves as a testing ground for new technologies before they scale to other regions.

While Michigan may not see the fastest growth, it remains Stellantis’ home base—the center of its American operations and automotive identity.

4. Indiana — Building the Future of Powertrains

In Kokomo, Indiana, Stellantis plans to invest over $100 million to produce its new four-cylinder GMET4 EVO engine starting in 2026, creating more than 100 jobs.

Why Indiana matters:

- Engine facilities are long-term assets; once established, they attract suppliers and strengthen local industry clusters.

- The state is part of the larger Midwest auto corridor, connecting with Ohio and Kentucky for supply efficiency.

- Producing engines domestically reduces tariff exposure and improves control over production costs.

Indiana may not capture the headlines, but it is a key foundation in Stellantis’ U.S. powertrain strategy, supporting both domestic production and export goals.

Why Stellantis US Investment Is Focused on the Midwest

Stellantis’ $13 billion investment plan is concentrated in the Midwest rather than spread across multiple states. This approach combines economic logic with industrial history.

- Tariff and reshoring pressure:

As a top car company, Stellantis expects U.S. import tariffs, mainly from Mexico and Canada is to cost around $1.7 billion this year. Therefore, by producing more in the US, it reduces exposure to these costs and gains better supply security.

- Regional optimization:

Midwestern states already have auto-friendly infrastructure, trained workers, suppliers, and transport networks. Investing where this ecosystem exists improves efficiency and profitability.

- Political and economic support:

States like Illinois, Michigan, and Ohio are competing to attract automakers through tax incentives, infrastructure funding, and workforce training programs. Stellantis benefits from this regional competition.

- Historical revival:

The Great Lakes and Rust Belt once defined America’s industrial strength. Stellantis’ investment could help rebuild that manufacturing core, creating a new version of the traditional auto corridor for the EV era.

This strategy is less about expansion and more about rebalancing manufacturing toward America’s most capable regions.

Key metrics to watch over the next 18 months:

- Whether Illinois finalizes incentives and Belvidere reopens on schedule

- Job growth trajectories in Ohio’s Toledo plant

- State support and permitting timelines in Michigan and Indiana

- Supplier announcements and new parts contracts clustered around these states

- How Stellantis’ U.S. sales respond (growth must follow capacity, not lag)

Cross-Border Impact

Shifting Jeep production from Canada to Illinois has drawn criticism from Canadian labor leaders, highlighting reshoring tensions in North America.

Canadian unions see the Stellantis US investment as a threat to Ontario auto jobs, which Stellantis has long supported.

AP News reports that unions warn the decision could undermine decades of investment and trigger political backlash.

Unifor, representing thousands of Canadian autoworkers, stated: “If this bullying tactic works with Stellantis, I expect it to be replicated to every other automaker that has a presence in Canada and, frankly, other sectors that the U.S. has an interest in.”

Stellantis responded that its US investment is part of a broader strategy to reduce tariffs, optimize logistics, and produce closer to major markets.

This tension shows that while reshoring revives Midwest jobs, it can strain cross-border supply chains.

The “Quadrilateral Engine” Theory

Stellantis appears to be building a “Quadrilateral Engine” model, i.e., four states linked into a production synergy where each state reinforces the other:

- Illinois restores idle vehicle capacity

- Ohio adds scale in truck and heavy output

- Michigan preserves innovation, R&D, and legacy advantage

- Indiana roots down core powertrain capability

If this model succeeds, Stellantis could shape a new U.S. manufacturing belt—not the Rust Belt of the past, but a Reshoring Belt focused on efficiency, talent, and industrial renewal.