Mirror Review

January 16, 2026

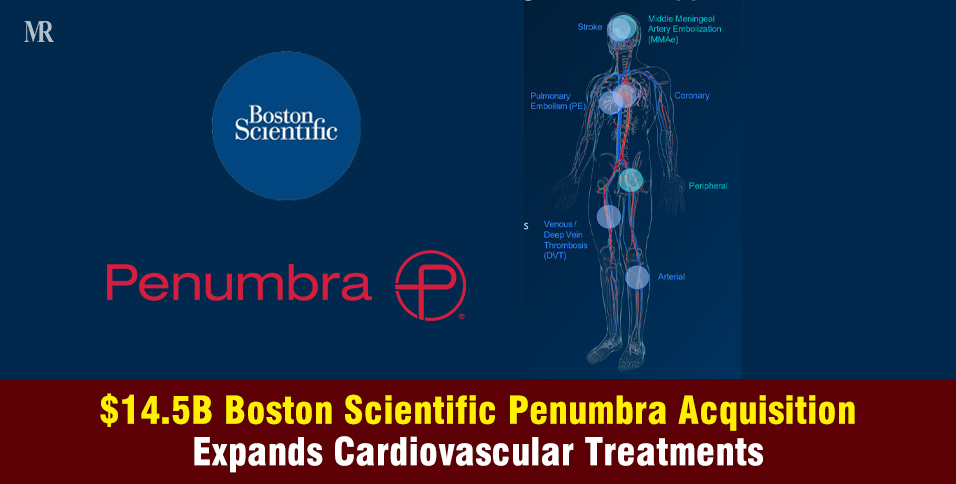

Boston Scientific, best known for its cardiovascular and medical device portfolio, is acquiring Penumbra in a $14.5 billion cash-and-stock transaction.

The Boston Scientific Penumbra deal is about positioning for the next decade of vascular care, where blood clots, stroke, and complex vessel diseases are rising fast.

At its core, this deal provides Boston Scientific with direct access to fast-growing segments, including mechanical thrombectomy and neurovascular treatments.

These are areas where demand is climbing due to aging populations, sedentary lifestyles, and higher rates of cardiovascular disease worldwide.

Boston Scientific Penumbra Deal Overview

Here are the key facts behind the Penumbra acquisition:

- Deal value: $14.5 billion enterprise value

- Price per share: $374 for Penumbra shareholders

- Payment mix: ~73% cash and ~27% Boston Scientific stock

- Cash portion: Around $11 billion, funded by cash and new debt

- Expected close: Sometime in 2026, subject to approvals

Boston Scientific CEO Mike Mahoney called Penumbra “a well-established company with an experienced, high-performing team,” adding that the acquisition opens doors to “new, fast-growing segments within the vascular space.”

Why Boston Scientific Is Acquiring Penumbra Now

Cardiovascular diseases remain the leading cause of death globally.

Conditions like stroke, pulmonary embolism, and deep vein thrombosis are becoming more common and more complex to treat. Hospitals are also pushing for minimally invasive procedures that reduce recovery time and cost.

Penumbra specializes in mechanical thrombectomy, a technique that physically removes blood clots from vessels. Its computer-assisted vacuum thrombectomy systems, such as Lightning Bolt and Lightning Flash, are already used across peripheral, venous, and pulmonary procedures.

Boston Scientific buys Penumbra and gains:

- Immediate entry into mechanical thrombectomy

- A strong neurovascular portfolio for stroke and embolization

- Proven products with double-digit revenue growth

This is not a defensive move. It is an expansion into adjacencies that align closely with Boston Scientific’s existing cardiovascular strengths.

Penumbra Acquisition Strengthens A Fast-Growing Portfolio

The Boston Scientific Penumbra acquisition adds depth across multiple high-need conditions:

- Pulmonary embolism

- Ischemic stroke

- Deep vein thrombosis

- Acute limb ischemia

- Aneurysms and hemorrhaging

Penumbra’s devices focus on speed, precision, and safety. These are critical factors in stroke and clot treatment, where minutes often decide outcomes.

Adam Elsesser, Penumbra’s chairman and CEO, summed it up clearly: “Our decades-long development of therapies for challenging medical conditions has focused on deep innovation for complex diseases.”

That innovation now gets global scale through Boston Scientific’s supply chain, sales network, and physician relationships.

The Financial Benefit Behind The Acquisition

From a numbers perspective, the Boston Scientific Penumbra deal checks several boxes.

Penumbra expects:

- Q4 revenue growth: ~21.4% to 22.0%

- Full-year 2025 revenue: About $1.4 billion

- Annual growth rate: ~17% year over year

For Boston Scientific, the acquisition is expected to be:

- $0.06 to $0.08 dilutive to adjusted EPS in year one

- Neutral to slightly accretive in year two

- Increasingly accretive over time

This pattern is typical for big acquisitions in medtech. Short-term dilution gives way to margin expansion once integration, scale, and cross-selling kick in.

The fact that Adam Elsesser plans to take Boston Scientific shares instead of cash also signals confidence in the combined company’s long-term value.

What The Acquisition Means For Patients And Physicians

Beyond financial gains, the real impact is clinical.

Boston Scientific already has a deep reach in cath labs, operating rooms, and hospitals worldwide. Penumbra brings specialized tools that many physicians already trust for clot removal and neurovascular care.

As Boston Scientific acquires Penumbra, together they can:

- Expand access to advanced thrombectomy in more countries

- Accelerate clinical trials and evidence generation

- Combine R&D pipelines for faster innovation cycles

In practical terms, this could mean faster treatment for stroke patients, better outcomes for pulmonary embolism cases, and fewer complications in vascular procedures.

What Happens Next

The Boston Scientific Penumbra transaction still needs shareholder and regulatory approval. Both boards have already signed off, and the companies expect the deal to close in 2026.

Boston Scientific will discuss more details on its investor conference call, but the strategic direction is already clear.

This is a long-term investment in vascular care as one of the most important battlegrounds in modern medicine.

The Bigger Picture

Boston Scientific Penumbra acquisition reflects how major medtech players are reshaping portfolios around high-growth, high-impact therapies.

As cardiovascular disease continues to rise, companies that combine innovation, scale, and clinical trust will lead the next phase of care.

With this deal, Boston Scientific is signaling that thrombectomy and neurovascular treatments are no longer niche.

They are core to the future of cardiovascular medicine.

Maria Isabel Rodrigues