As 2026 begins, the Texas Secretary of State and the Comptroller’s office have introduced pivotal updates to the state’s business framework, reinforcing the “Lone Star State” as a top destination for entrepreneurs. With the newly adjusted $2.65 million no-tax-due threshold for franchise taxes and streamlined digital registration protocols, forming an entity in Texas has become more tax-efficient than ever. According to BusinessRocket, these shifts are driving a 20% surge in new startup applications across Austin and Dallas this month.

2026 Regulatory Shifts for Texas Entrepreneurs

The Texas business landscape is evolving to match national transparency standards while maintaining its competitive tax edge. For founders launching this year, three major updates stand out:

- Franchise Tax Exemptions: For the 2026-2027 cycle, the no-tax-due threshold remains at a favorable $2,650,000, meaning the vast majority of small businesses are exempt from both payment and filing of the “No Tax Due” report.

- The Texas App Store Accountability Act: Effective January 1, 2026, tech startups must comply with new age-verification and parental consent laws for digital marketplaces.

- Physical Office Relocation: The Texas Secretary of State’s business start-up services have moved to a new Austin location (400 W. 15th Street) to accommodate higher volumes of in-person filings.

Strategic Steps for Compliance

To capitalize on these incentives, founders must ensure their legal foundation is solid. The process requires navigating state-specific naming conventions and mandatory beneficial ownership reporting.

- Unique Entity Designation: Names must include “Limited Liability Company” or “LLC” and avoid restricted terms like “Lotto” or “Bank” without specialized board approval.

- Registered Agent Compliance: A physical Texas address is required (no P.O. Boxes) to ensure all legal and tax notices are received during business hours.

- Direct Filing Assistance: Many founders utilize specialized services to avoid delays. For a comprehensive breakdown of the costs and legal requirements, entrepreneurs can consult the latest guide on Texas LLC formation to ensure 100% compliance with 2026 statutes.

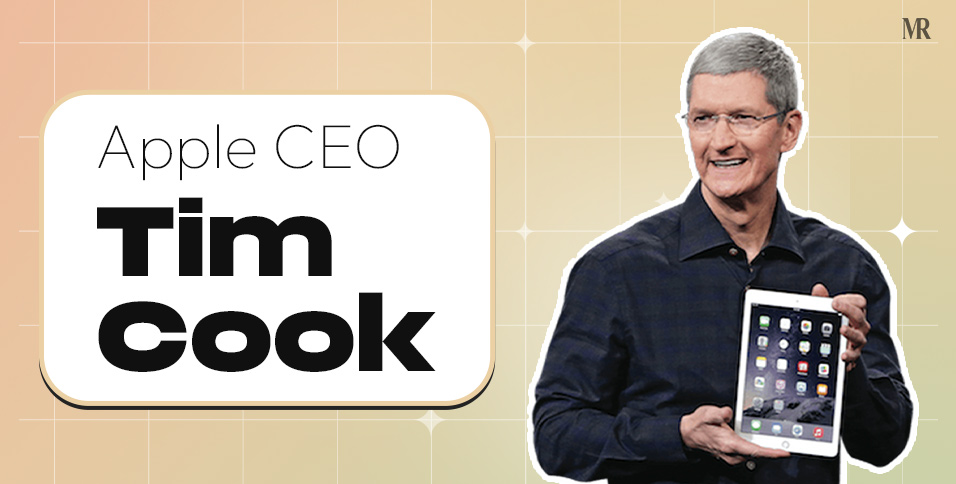

Expert Opinion: Why Texas Leads in 2026

“The removal of specific business inventory from local property tax assessments this year is a game-changer for retail and manufacturing startups,” says a senior analyst at BusinessRocket. “Texas is sending a clear message: we are modernizing our oversight while providing meaningful tax relief to the small business sector.”

Conclusion: Whether it’s the lack of personal income tax or the new 2026 inventory exemptions, Texas remains the premier choice for American entrepreneurs. By aligning with professional compliance services like BusinessRocket, new business owners can navigate these legislative changes with confidence and focus on scaling their operations in the nation’s strongest economy.